- Outcomes

-

Resources

-

SupportOur support team is ready to help, whether you’re an employer, member, or broker.

-

Case StudiesSeeing our solution in action.

-

BlogInsights and updates to help navigate the health insurance landscape.

-

PodcastsA collection of conversations built to inspire.

-

Webinar & GuidesInsights and resources to help your organization thrive.

-

- About Us

-

Account login

- Contact Us

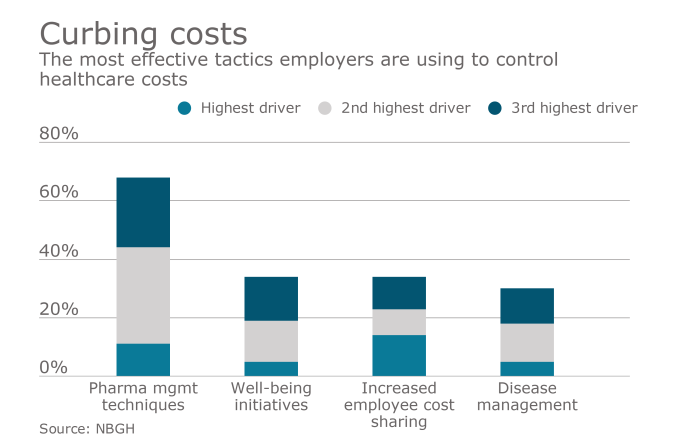

Amanda Eisenberg from Benefits News takes a look at how increases in employee healthcare (5-10% for many employees) is causing a shift to more self-funding.

Amanda Eisenberg from Benefits News takes a look at how increases in employee healthcare (5-10% for many employees) is causing a shift to more self-funding.