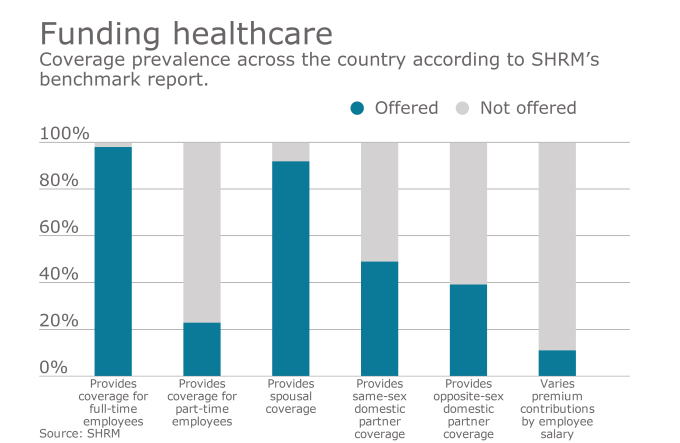

As the cost of providing employees with healthcare benefits rises (at an average of $500 per employee this year), many employers are choosing to push those costs onto employees in order to maintain budgets.

Read the full original article from Benefits News.

A report from SHRM (Society for Human Resource Management) details the ways that many companies are shifting more costs to employees, including moving to high deductible health plans (HDHPs). “HDHPs such as health savings accounts (HSAs) and health reimbursement arrangements (HRAs) are one way that employers are attempting to counter the high costs,” Evren Esen, director of workforce analytics at SHRM, says.

Employers don't need to shift costs onto employees to stay within budget. Partial-self insurance, an innovative healthcare benefits model, can save organizations a baseline of 12.5% on healthcare costs while also eliminating employee out-of-pocket expenses. Download the Nonstop Quick Guide to Partial Self-Insurance to learn more: