Peter Ubel writes for Forbes about the cost-benefit decisions doctors and patients must make in the face of rising out-of-pocket healthcare costs.

Read the full article at: www.forbes.com

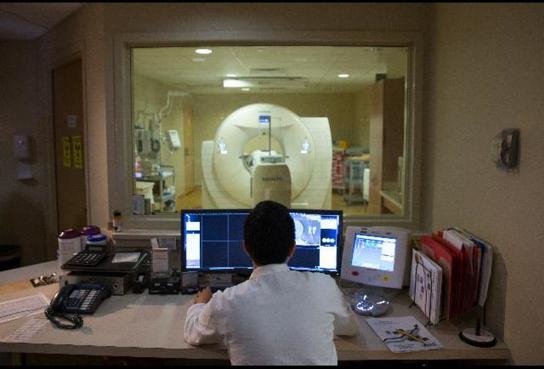

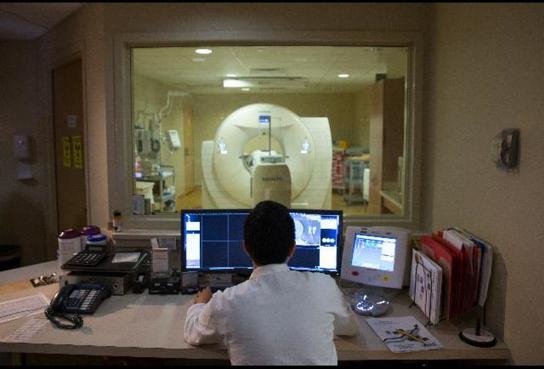

Ubel uses an example of a woman who must choose between a CT scan or a more thorough PET scan to check her body for cancerous tumors. Decisions like these must be made every day by patients who cannot afford the increasing out-of-pocket healthcare costs. Sometimes the decisions are simple, and a less expensive medical test will yield similar results. But what happens when a cheaper alternative is not as good? Are patients forced to settle for sub-standard care?

When people pay out-of-pocket for a significant portion of their medical expenses, we can expect them to make these kinds of tough decisions. Good decision-making requires doctors and patients to weigh the pros and cons of all available alternatives, including the financial burden patients might experience from high out-of-pocket costs.

It's important for nonprofits to keep out-of-pocket

healthcare costs low for employees even in the

face of budget cuts - download our guide to learn more: