This year marks the first year applicable large employers (ALE; 50+ full time or full-time equivalent employees) are required to report employer-sponsored healthcare coverage to the IRS and provide statements to full-time employees under IRS Sections 6055 and 6056. To help circumvent common misperceptions and errors, this two-part blog series will look at: 1) what needs to be reported, what forms need to be used, and who needs to comply with reporting requirements; and 2) methods of reporting, deadlines, and penalty relief.

What needs to be reported?

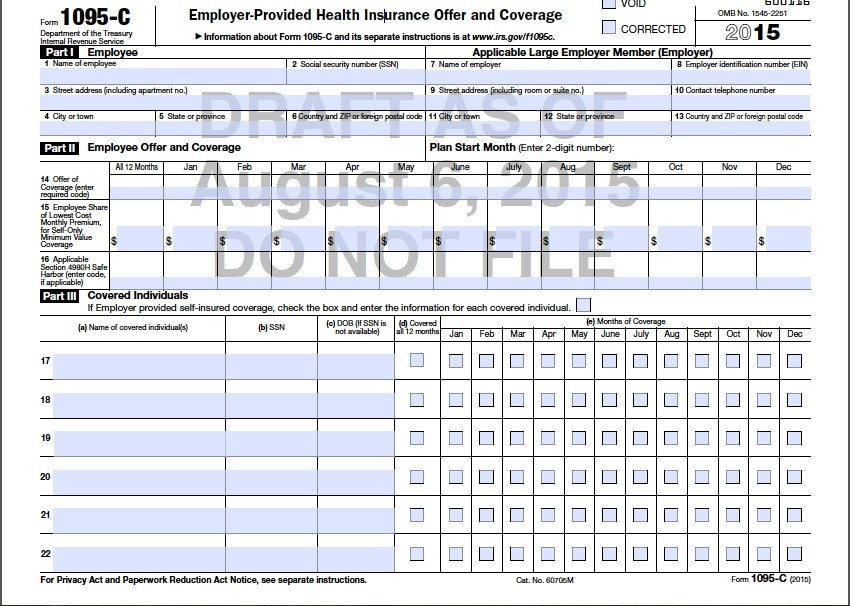

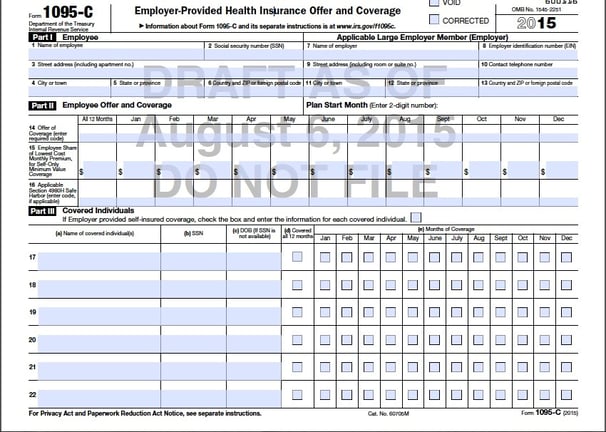

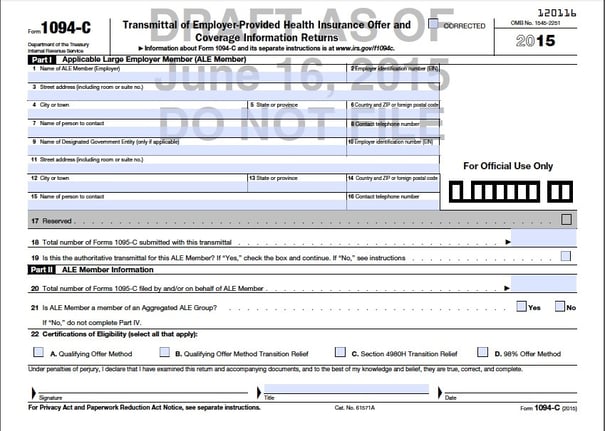

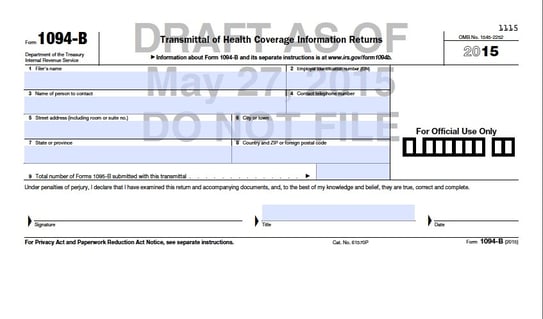

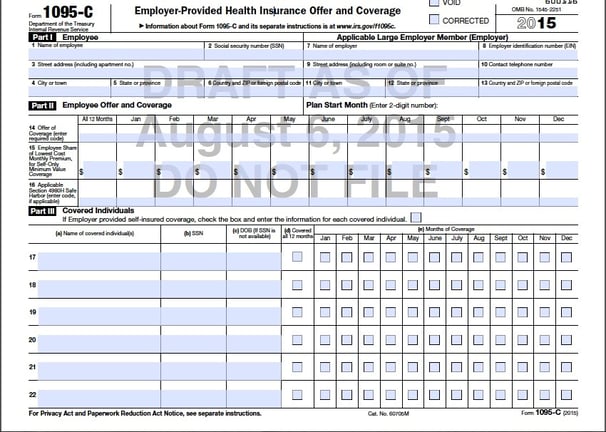

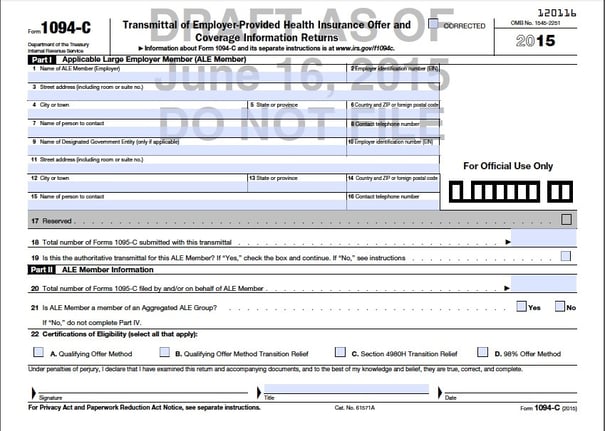

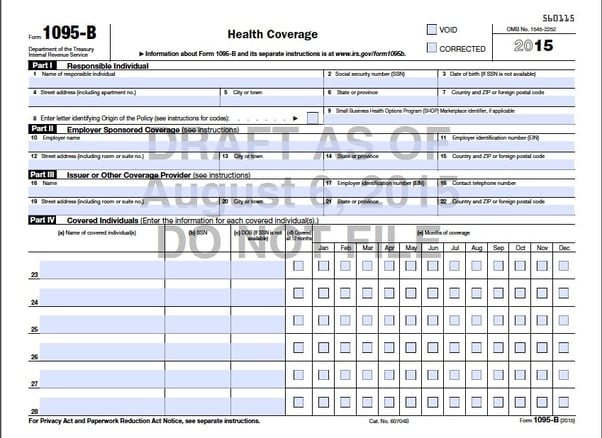

All ALEs are required to report on health coverage offerings for all full-time employees (by month), regardless of if coverage was offered and/or accepted by none, some or all employees using Form 1095-C*, Employer-Provided Health Insurance Offer and Coverage and Form 1094-C*, Transmittal of Employer-Provided Health Insurance Offer and Coverage Information Returns. In addition, ALEs are required to provide a statement to each full-time employee with the same information reported to the IRS using Form 1095-C*, which helps employees determine if they qualify for the premium tax credit.

The IRS has published a quick guide for these two forms, detailing the information needed for both. For ALEs that self-insure, section III of Form 1095-C* needs to be filled out; for employers who offer fully insured coverage, section III can be left blank.

Who is expected to report?

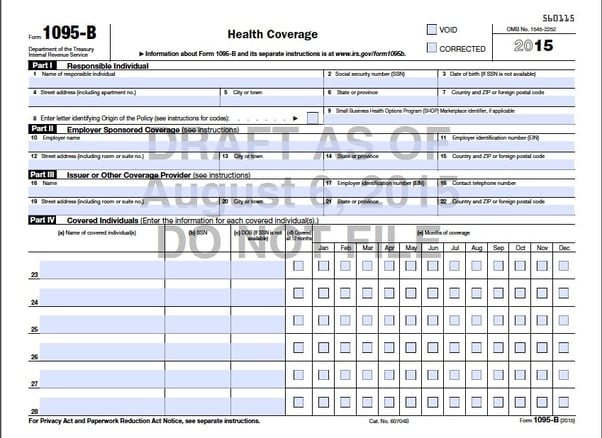

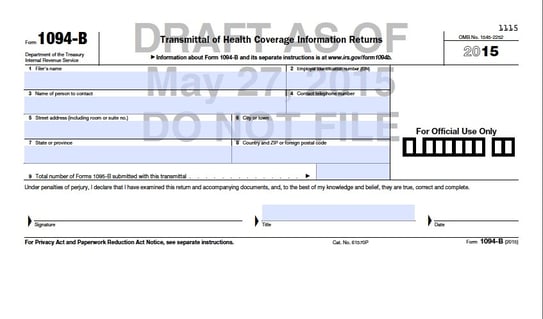

No matter if you are fully insured through a carrier or self-insure group coverage, all ALEs are expected to provide information to the IRS. This includes for-profit, nonprofit, and government organizations. If an organization is part of an aggregated group that qualifies as an ALE, each company is required to file their own forms for all full-time employees using its individual employer identification number (EIN), regardless of if the individual organization has 50+ full-time employees or not. Organizations who do not qualify as an ALE but do provide self-insured coverage are required to report to the IRS and provide employee statements (using Form 1095-B and Form 1094-B) even though they are not subject to the employer shared responsibility provisions.

For more information about ACA reporting requirements, check out our webinar on September 29th or contact Nonstop directly.

* Please note these forms are current DRAFT documents. The IRS has not released final documents for Forms 1095-C, 1094-C, 1095-B, or 1094-B.

IRS Form 1095-C*

IRS Form 1094-C* (page 1)

IRS Form 1095-B*

IRS Form 1094-B*

Want to join Nonstop and reporting expert Rachel Johnson to learn more about these new forms?

Sign up for our webinar on September 29th, 2015: