Photo: calendarswamp.blogspot.com

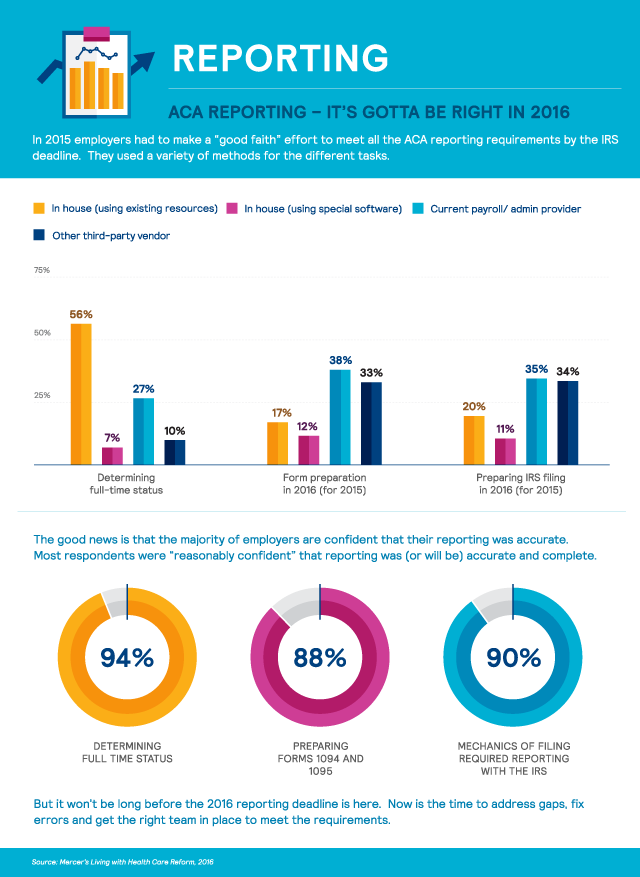

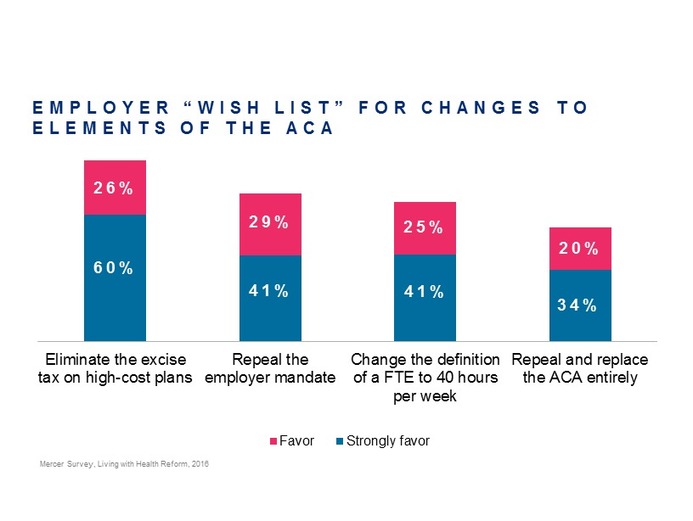

It may seem premature to begin thinking about 2017 tax season when we haven’t even started in on the 2016 one yet, but when it comes to the ACA earlier is always better. Especially if your organization is – or will be - an applicable large employer (ALE) in 2016, and required to offer 95% of employees affordable healthcare. Understanding all of the employer mandates – from dependent care, to cafeteria plans, to the shared responsibility requirement – is absolutely crucial to planning for 2016 and essential to saving potentially multiple thousands of dollars in penalties.