Employers anticipate healthcare benefits costs will rise 5% next year - Fierce Healthcare

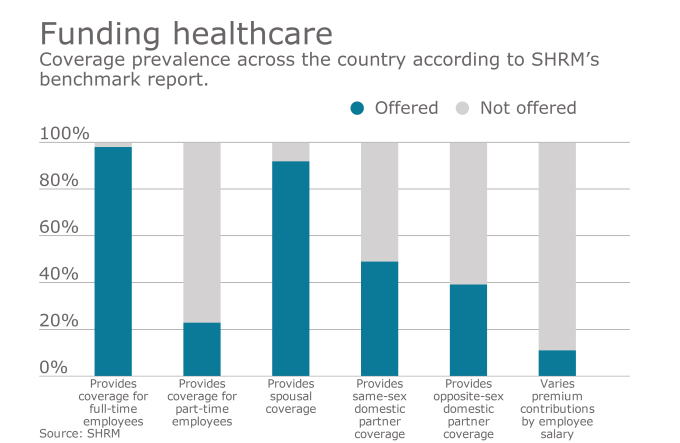

This article by Leslie Small for Fierce Healthcare discusses what employers are doing to counter the predicted 5% increase in heathcare benefits costs over the next year.